Introduction

In the contemporary world of finance, wealth management has evolved far beyond the traditional scope of simple savings and fixed deposits. Investors are increasingly seeking diversified strategies to protect, grow, and optimize their portfolios. With globalization, technological innovation, and complex market dynamics, wealth creation and management have become intricate fields requiring careful analysis, foresight, and expertise.

Among the influential figures in this domain, those whose practices exemplify strategic thinking, risk management, and long-term growth, such as pedro vaz paulo wealth investment, provide insight into modern wealth accumulation. This article delves into the principles of wealth management, investment strategies, risk considerations, and emerging trends shaping the future of finance.

The Foundations of Wealth Investment

Wealth investment begins with a clear understanding of financial goals, risk tolerance, and market opportunities. Foundational concepts include asset allocation, diversification, and portfolio balancing. Proper management ensures that capital is not only preserved but also positioned for sustainable growth.

Financial advisors and investment professionals emphasize that wealth management is as much about psychological discipline as it is about technical knowledge. Investors must be patient, informed, and adaptable to shifting market conditions. The approach followed by pedro vaz paulo wealth investment highlights disciplined decision-making combined with strategic foresight, offering a model for successful portfolio development pedro vaz paulo entrepreneur.

Understanding Risk and Return

Every investment carries a level of risk, balanced by potential returns. Understanding this balance is critical for long-term wealth preservation. High-risk investments, such as equities or venture capital, may yield substantial returns but also expose investors to significant volatility. Conversely, safer assets like government bonds offer stability with modest gains.

Successful wealth management requires careful risk assessment. Techniques like scenario analysis, stress testing, and diversification mitigate exposure while optimizing potential returns. Insights from strategies implemented by pedro vaz paulo wealth investment demonstrate the value of measured risk-taking combined with diversified holdings across various asset classes.

Diversification as a Core Principle

Diversification reduces the impact of individual asset volatility on an investor’s portfolio. By spreading investments across equities, bonds, real estate, and alternative assets, investors can achieve more stable returns over time. Modern portfolio theory supports the idea that combining uncorrelated assets minimizes overall risk.

Sophisticated wealth strategies incorporate global diversification, taking advantage of opportunities across regions and sectors. Techniques employed by pedro vaz paulo wealth investment emphasize combining traditional and alternative investments to optimize both performance and resilience against market fluctuations.

The Role of Equities in Wealth Growth

Equities, or stocks, remain a central component of wealth creation. They provide opportunities for capital appreciation and, in some cases, dividends. Investors must analyze companies, industries, and macroeconomic factors to make informed decisions.

Active management involves evaluating growth potential, market trends, and competitive positioning. Conversely, passive strategies, such as index funds, offer broad market exposure with lower fees. The approach to equities observed in pedro vaz paulo wealth investment often blends active and passive strategies to balance performance, risk, and cost efficiency.

Fixed Income and Stability

Fixed-income securities, including bonds and treasury instruments, offer stability and predictable returns. They are particularly useful for investors seeking to protect capital while generating steady income. Portfolio allocation to fixed-income instruments is often adjusted based on interest rate expectations, inflation, and broader economic indicators.

Wealth strategies like those employed by pedro vaz paulo wealth investment emphasize the importance of fixed-income assets as a stabilizing component within diversified portfolios, ensuring resilience during market volatility.

Real Estate and Tangible Assets

Real estate remains a key pillar of wealth investment. Beyond its potential for capital appreciation, real estate provides income through rental yields and offers portfolio diversification with low correlation to equities.

Investors must consider location, property type, market trends, and long-term economic projections. Luxury residential, commercial, and industrial real estate each have unique risk-return profiles. Strategies similar to those highlighted by pedro vaz paulo wealth investment underscore the careful evaluation of property markets as a means to secure long-term financial stability.

Alternative Investments

Alternative investments, including private equity, hedge funds, commodities, and collectibles, provide additional diversification and potential for high returns. They often require specialized knowledge and longer investment horizons.

These assets are less liquid than traditional investments, making due diligence crucial. The portfolio design insights drawn from pedro vaz paulo wealth investment illustrate how alternative investments can complement traditional assets, providing enhanced portfolio resilience and unique growth opportunities.

Tax Optimization and Legal Structures

Efficient tax planning is essential for wealth preservation. Strategies include utilizing tax-advantaged accounts, trusts, and legal structures that reduce tax liability while maintaining compliance. Proper planning ensures more capital remains invested and compounds over time.

Experts like those associated with pedro vaz paulo wealth investment often integrate tax-efficient strategies into broader wealth management frameworks, highlighting the interplay between legal structures, taxation, and long-term portfolio growth.

Technological Innovation in Wealth Management

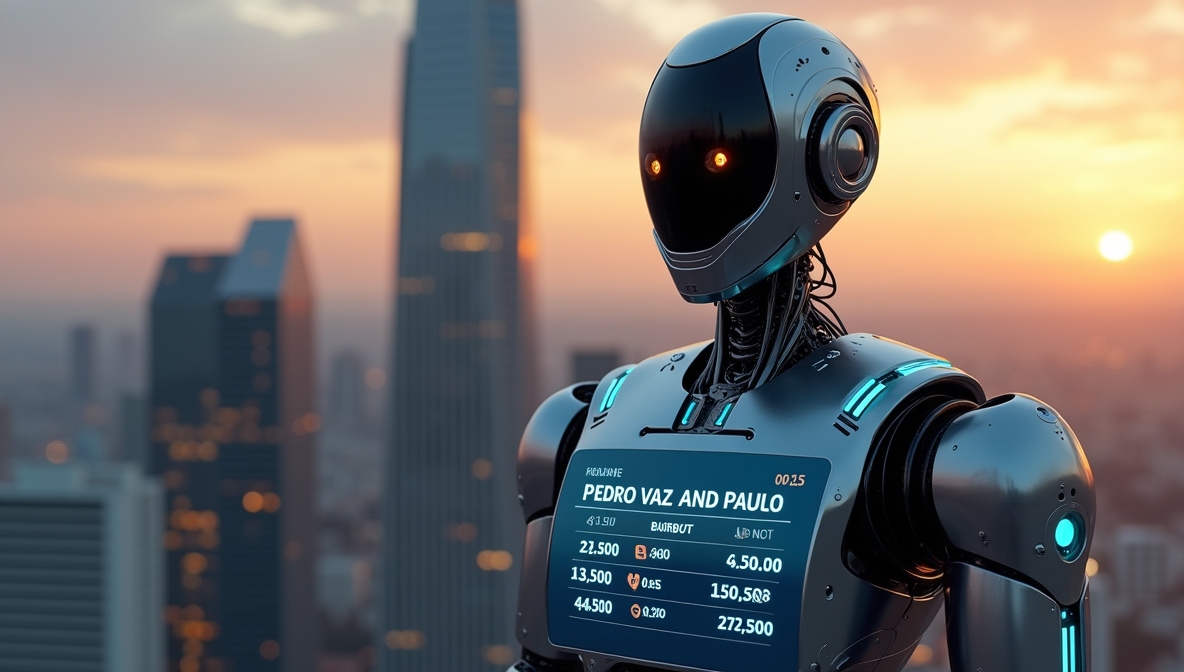

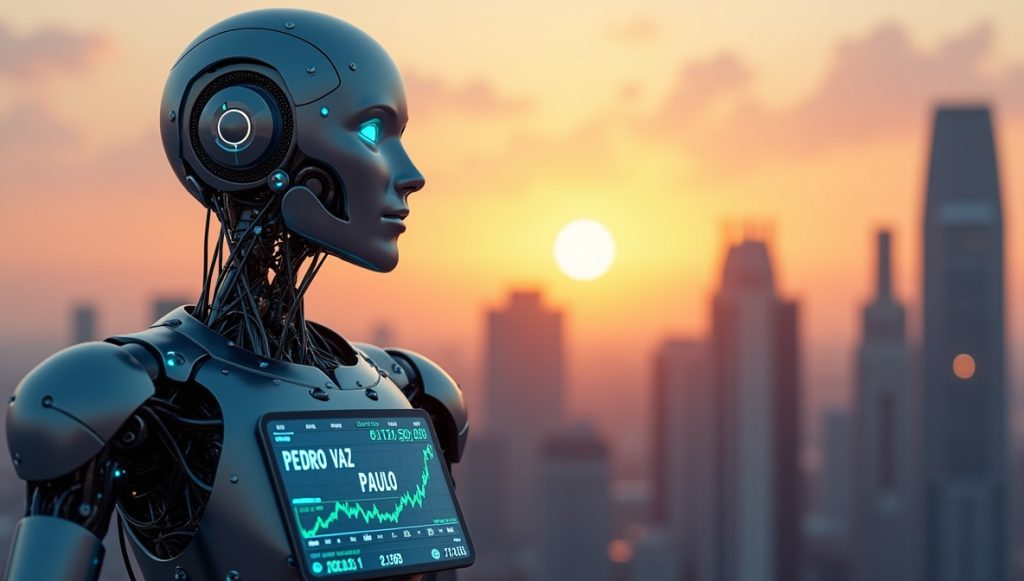

Technology has transformed how investors manage wealth. Digital platforms, robo-advisors, algorithmic trading, and artificial intelligence provide data-driven insights for better decision-making.

Investment professionals leverage these tools to analyze trends, model scenarios, and optimize portfolios with greater precision. Strategies exemplified by pedro vaz paulo wealth investment incorporate advanced analytics to refine asset allocation, monitor risk, and identify emerging opportunities efficiently.

Behavioral Finance and Investor Psychology

Understanding human behavior is critical in wealth investment. Cognitive biases, emotional decision-making, and herd behavior can undermine investment outcomes.

Effective wealth strategies include developing discipline, adhering to long-term plans, and maintaining objectivity during market fluctuations. Observations from pedro vaz paulo wealth investment stress that investor psychology is as significant as market analysis in achieving sustained success.

Global Market Considerations

Globalization has created both opportunities and challenges in wealth management. Currency fluctuations, geopolitical events, and cross-border investment regulations influence portfolio performance.

Diversifying internationally can protect against localized market volatility while offering access to growth markets. The approach taken by pedro vaz paulo wealth investment incorporates global market perspectives, ensuring portfolios are balanced across regions, currencies, and economic sectors.

Sustainable and ESG Investing

Environmental, social, and governance (ESG) factors have become central to modern investment philosophy. Investors increasingly seek opportunities that align with ethical considerations and long-term sustainability.

Integrating ESG principles can reduce risk and appeal to socially conscious investors. Strategic frameworks similar to pedro vaz paulo wealth investment often evaluate ESG criteria alongside traditional financial metrics, creating portfolios that are both profitable and responsible.

Estate Planning and Wealth Transfer

Wealth management extends beyond accumulation to preservation and transfer. Estate planning ensures that assets are efficiently distributed according to personal wishes while minimizing taxes and legal complications.

Trusts, wills, and charitable foundations play critical roles in estate planning. Professionals associated with pedro vaz paulo wealth investment emphasize integrating estate planning with broader investment strategies to secure intergenerational wealth and maintain long-term financial objectives.

Retirement Planning

Retirement planning is a fundamental component of wealth investment. Investors must estimate future expenses, assess life expectancy, and project income from various sources.

Diversifying retirement accounts across stocks, bonds, and real estate, while considering tax implications, ensures sufficient income during retirement years. Strategies exemplified by pedro vaz paulo wealth investment emphasize a disciplined, long-term approach to retirement planning that balances risk, return, and lifestyle expectations.

The Importance of Continuous Education

Financial markets evolve constantly, demanding continuous learning. Investors who stay informed about market trends, emerging technologies, and global events are better positioned to adapt strategies effectively.

Professional insights, reports, and analyses from platforms aligned with pedro vaz paulo wealth investment provide structured knowledge, helping investors make informed decisions and seize new opportunities as they arise.

Conclusion

Wealth investment today requires a comprehensive, disciplined, and informed approach. From traditional assets like equities and bonds to alternative investments, real estate, and ESG-focused opportunities, successful investors employ diversified strategies to optimize growth and mitigate risk.

Figures and methodologies exemplified by pedro vaz paulo wealth investment demonstrate the importance of integrating risk management, strategic planning, technological tools, and behavioral awareness into portfolio design. By combining these elements, investors can achieve long-term financial stability, growth, and the fulfillment of personal and professional goals.

The evolving financial landscape continues to offer both challenges and opportunities. By embracing diversification, continuous learning, ethical considerations, and innovative strategies, modern investors are empowered to navigate complexity with confidence. The principles illustrated by pedro vaz paulo wealth investment serve as a guide for aspiring and experienced investors alike, emphasizing that wealth creation is a journey rooted in informed decision-making, foresight, and resilience.