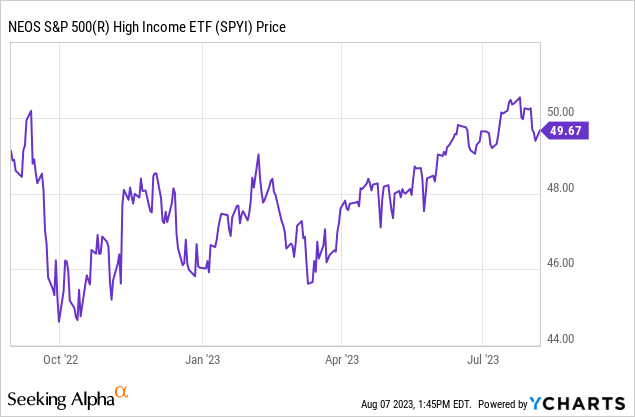

SPYI dividend history is a key factor for investors seeking consistent income from their portfolios. The Neos S&P 500 High Income ETF (SPYI) offers monthly dividends, making it an attractive option for those looking to generate regular cash flow. As of September 2025, SPYI boasts an impressive annual dividend yield of 11.75%, translating to $6.12 per share over the past year StockAnalysis. This high yield is particularly appealing in a low-interest-rate environment, where traditional savings accounts and bonds offer minimal returns.

The ETF’s monthly payout structure provides investors with frequent income, which can be reinvested or used to meet regular expenses. For instance, the dividend paid on September 26, 2025, was $0.527 per share, reflecting a 1.8% increase from the previous month’s payout of $0.5176 Market Chameleon. Such consistent increases in dividend payouts highlight SPYI’s commitment to delivering value to its shareholders. However, it’s important to note that a significant portion of these distributions is classified as a return of capital, which may have tax implications for investors

SPYI Dividend History: A Complete Guide for Investors

Investors often search for steady income sources, and SPYI dividend history provides a clear picture of how this ETF performs in distributing returns. The SPYI, officially known as the Neos S&P 500 High Income ETF, has gained attention for its high dividend yield and monthly payouts. Understanding its dividend history can help investors make informed decisions about whether this ETF fits into their income-focused investment strategy.

The SPYI dividend history reveals patterns of monthly distributions, growth in payout amounts, and important details about tax treatment. With a focus on regular income, SPYI offers a unique opportunity for both long-term investors and those seeking supplemental cash flow. By analyzing past performance, we can better anticipate future dividend behavior and evaluate the overall reliability of this ETF as a source of income.

What Is SPYI and Why Dividends Matter

SPYI is designed to provide high monthly income by investing in S&P 500 companies while using a covered call strategy. This combination allows it to generate extra income on top of the underlying stock dividends. The ETF distributes most of this income to its shareholders in the form of monthly dividends.

Dividends are important because they represent real cash returns to investors. Instead of relying solely on stock price appreciation, investors receive tangible monthly income that can be reinvested or used for living expenses. With SPYI, investors benefit from both capital gains potential and high dividend payments, making it attractive in a low-interest-rate environment.

Understanding SPYI Dividend History

The SPYI dividend history shows a pattern of consistent monthly payments, which is relatively rare among ETFs. Typically, dividends fluctuate due to changes in the underlying stock income, but SPYI aims to maintain a steady flow.

Historically, SPYI’s dividend payments have been higher than traditional ETFs due to the covered call strategy. For example, the dividend paid in September 2025 was $0.527 per share, showing a slight increase from the previous month’s $0.5176 per share. These consistent increases indicate a commitment to returning value to investors, even if some portion of the distributions is classified as a return of capital.

Monthly Payouts: How SPYI Delivers Income

One of the standout features of SPYI is its monthly payout schedule. While many ETFs pay quarterly, SPYI distributes dividends every month. This frequent payout is appealing to investors who rely on investment income for recurring expenses or prefer to reinvest dividends regularly to compound growth.

The monthly payout schedule also allows investors to track income more closely and adjust their portfolios accordingly. With SPYI, each dividend announcement is closely watched by income-focused investors because even small increases can significantly affect annual returns.

The Role of Return of Capital in SPYI Dividends

It’s important to understand that not all SPYI dividends come from profits. A portion is classified as a return of capital (ROC), which essentially means investors are receiving part of their original investment back.

While ROC can still provide cash flow, it does not represent new earnings and may have tax implications. Investors should review their statements carefully and consider consulting a tax advisor to understand how ROC distributions affect their taxable income.

Tax Implications of SPYI Dividend Payments

SPYI dividends, including those classified as ROC, are subject to taxation. Regular dividends are taxed at standard income rates, while return of capital is typically not taxed immediately but reduces the cost basis of the investment.

Understanding the tax treatment is critical for investors who rely on dividend income. Proper planning ensures that high yields do not result in unexpected tax liabilities, which could offset the benefits of the income generated by SPYI.

Comparing SPYI with Other High-Yield ETFs

Investors often compare SPYI to other high-yield ETFs to determine which provides the best income potential. SPYI generally offers higher monthly yields due to its covered call strategy, while some other ETFs may provide lower but more predictable dividends.

When comparing, it’s important to consider the total return, including both dividends and potential changes in share price. High dividend yield alone does not guarantee overall profitability, so a careful assessment of risk and strategy is necessary.

Dividend Growth and Trends

Examining the SPYI dividend history over time shows steady growth in monthly payouts. Even small increases, when compounded over the year, contribute to a significant income boost for investors.

Trends in dividend growth reflect the ETF’s management strategy, performance of the underlying assets, and effectiveness of the covered call approach. Investors should look at multi-year data to understand long-term sustainability and potential for future growth.

SPYI in a Diversified Portfolio

SPYI can play an important role in a diversified investment portfolio. Its high monthly payouts complement other income-generating assets such as bonds, REITs, and traditional dividend stocks.

By including SPYI, investors can enhance portfolio income while maintaining exposure to the S&P 500. The covered call strategy adds an extra layer of return potential, though it may also slightly limit capital gains. Proper allocation depends on individual financial goals and risk tolerance.

Investor Considerations Before Buying SPYI

Before investing in SPYI, consider:

- Yield vs. Risk: High dividend yield may come with higher volatility.

- Return of Capital: Understand how ROC affects taxes and overall returns.

- Portfolio Fit: Ensure SPYI complements other assets in your portfolio.

- Market Conditions: Dividend stability may vary during market downturns.

By assessing these factors, investors can decide if SPYI aligns with their income and growth objectives.

Future Outlook for SPYI Dividends

Looking ahead, SPYI’s dividend policy is likely to continue monthly distributions with possible growth in payouts. Economic conditions, interest rates, and underlying stock performance will influence the exact amounts.

Investors should monitor market trends and SPYI announcements regularly. Maintaining a balance between income needs and portfolio risk will help maximize benefits from SPYI dividends.

Conclusion

The SPYI dividend history demonstrates a strong commitment to providing investors with consistent, high monthly income. While some dividends include return of capital, the overall yield remains attractive compared to other ETFs. Understanding past trends, tax implications, and portfolio impact is essential for making informed investment decisions.

FAQs

Q1: How often does SPYI pay dividends?

SPYI pays dividends monthly, which is more frequent than most ETFs that pay quarterly.

Q2: What is return of capital (ROC) in SPYI dividends?

ROC is part of the dividend that comes from your original investment rather than profits. It can affect taxes and reduce the cost basis of your investment.

Q3: Is SPYI dividend guaranteed?

No, dividends depend on fund performance and market conditions. Past performance does not guarantee future results.

Q4: How does SPYI compare to other high-yield ETFs?

SPYI generally offers higher monthly payouts due to its covered call strategy but may carry slightly higher risk compared to lower-yield ETFs.

Q5: Can SPYI be used for long-term income?

Yes, SPYI can provide consistent income, especially for investors who want monthly payouts, but it should be part of a diversified portfolio.